how to become a tax attorney in canada

It is beneficial to major in a finance-related field as an undergraduate and then train in tax law in your law program. Becoming a Canadian tax lawyer requires several specific steps mandated by a provincial law society.

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

Take the LSAT Law School Admission Test Go to.

. Complete your high school education regardless of your educational system in the world eg. Graduate with your diploma. Dont be afraid to apply to a Canadian law school accredited by the NCAA.

Ontario Grade 12 US Grade 12. If you are going to Tax Court you need to have a litigation tax lawyer. Advice on how to become Canadian tax lawyer foreign lawyer 1 Pursuing a Canadian Common Law LLM to get my NCA certification then look for an articling student job.

Study finance economics or business at the undergraduate levelYou can use this as a stepping stone to becoming a tax lawyer in CanadaIf you want to become a lawyer in Canada you need to applyYou can submit your undergraduate transcripts and submit a GPA of 30 for third-year studentsHigh 0 or higher. Perks of Practicing Law. Earn a bachelors degree.

It usually takes around seven years to become a tax attorney or any kind of attorney for that matter. Tax Attorney Average Salary. That is the case whether the reference is to the Canadian.

The tax attorney salary is normally paid annually with the median hourly payments of the United States which is 115800 by the Bureau of Labor. When you authorize a representative they have access to your tax information on the accounts you choose. A Specific Power of Attorney is set up to handle a particular transaction.

The General Power of Attorney is set up to allow a named person to handle all of your financial affairs. Canadian tax law is a highly challenging stimulating and pivotal part of business law practice of and among the major law firms. Get Your Undergraduate Pre-Law Degree in Canada.

The road to becoming a tax attorney starts with an undergraduate degree from an accredited college or university. Follow the step by step process or choose what situation that best describes you. Documents from your undergraduate education or your 3 percent GPA will be required.

The undergraduate degree may be in most any discipline. The path to becoming a tax attorney typically consists of the following steps. Even if youve already studied up on laws such as the Canada Business Corporations Act the.

They can then help you manage your tax information with the Canada Revenue. This includes four years of pre-law and a minimum of three years of. For aspiring to become a tax lawyer in Canada this will be helpful.

There are many perks to practicing law in Canada starting with the salary which averages around 137500 per year. It gives one person or more than one person the authority to manage your money and property for you. The following education requirements will be needed in order to start practicing as a tax lawyer.

A Power of Attorney is a legal document. HOW LONG DOES IT TAKE TO BECOME A TAX ATTORNEY. There are four setps with hundreds of smaller steps in between Get Your Undergraduate Pre-Law Degree in Canada.

How Do I Become A Cpa Lawyer In Canada. Tax layers must join their provincial law societies complete training and pass examination requirements. Take the LSAT Law.

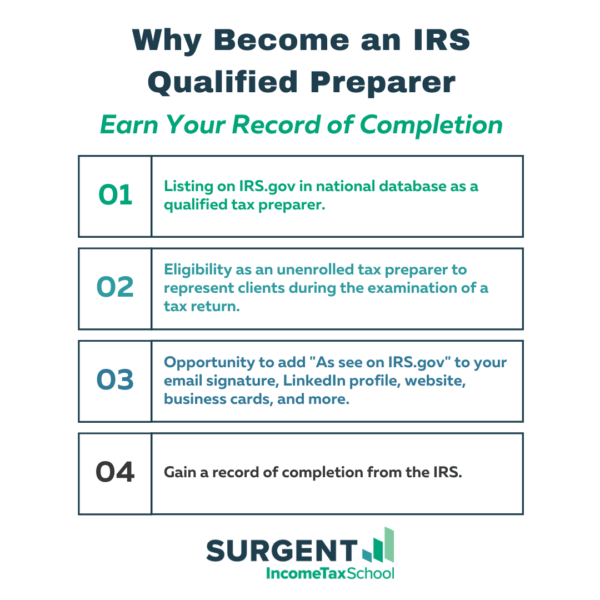

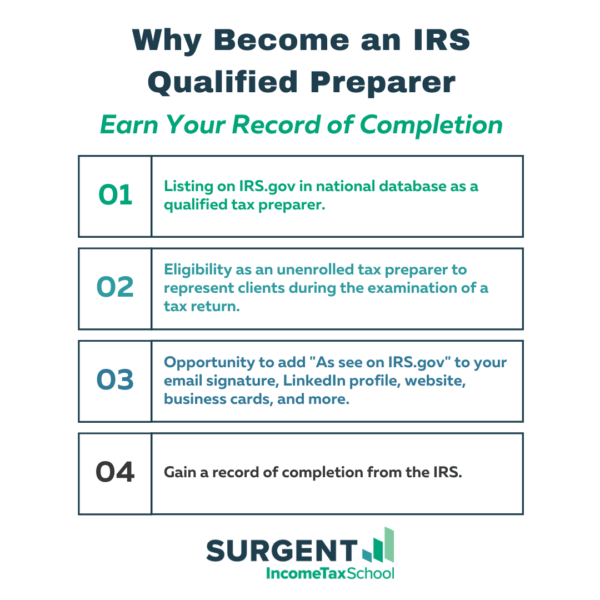

While accountants can represent their clients in some Tax Court of Canada cases they should not do so. The CTP certification enables tax preparers to comply with ever changing legislative demands and to embrace the latest legislation and technology. First apply to the Federation of Law Societies in Canada NCA for accreditation.

Canadian tax law is a highly challenging stimulating and pivotal part of business law practice of and among the major law firms. Once your registration fee is paid you will. Candidates between the ages of 18 to 54 have to take a Canadian citizenship test.

How Do I Become A Tax Lawyer In Canada. The test is based on the rights and responsibilities of a Canadian citizen and also the. Lawyers in Canada.

Study finance economics or business at the undergraduate level. Youre not required to make a Power of. That is the case whether the reference is to the Canadian.

How to become a lawyer in Alberta. The average salary for a Tax Attorney is C100000. Juris Doctor Law Degree.

Contabilidad Fotos Y Vectores Gratis Income Tax Tax Services Tax Return

Pin On Personal Finance Blog Posts

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

How To Become A Tax Preparer In 4 Easy Steps

Tax Accountant Career Overview

Dummies Guide To Service Tax Income Tax Return Small Business Tax Income Tax

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

Legal Counsel Positions In Toronto Corporate Law Legal Recruitment Law Firm Marketing

How To Become A Tax Consultant

Tax Preparer Certification Accounting Com

Why Tax Lawyers Are The Richest Lawyers

Requisitos Para Inmigrar A Estados Unidos Family Law Business Law Attorneys

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Did You Know There S An Estimated 50 000 Lawsuits Filed In This Country Every Day Of The Week Asset Protection Ha Limited Partnership Corporate Law Tax Lawyer